Q2 Market Review

The second quarter of 2025 delivered a powerful lesson in market and investor resilience, underscored by extreme volatility followed by decisive recoveries. What began as a highly disruptive period marked by sweeping U.S. tariff announcements and global geopolitical unease quickly shifted into one of strong market momentum. The end result was that corporate earnings outperformed expectations, inflation pressures eased further, and central banks began to signal more accommodative stances. While macroeconomic and policy risks remain elevated, the quarter reinforced our core investment principle: clarity of process, thoughtful asset allocation, and discipline remain the most consistent drivers of long-term success.

Tariffs to Tech: Equities Find Their Footing

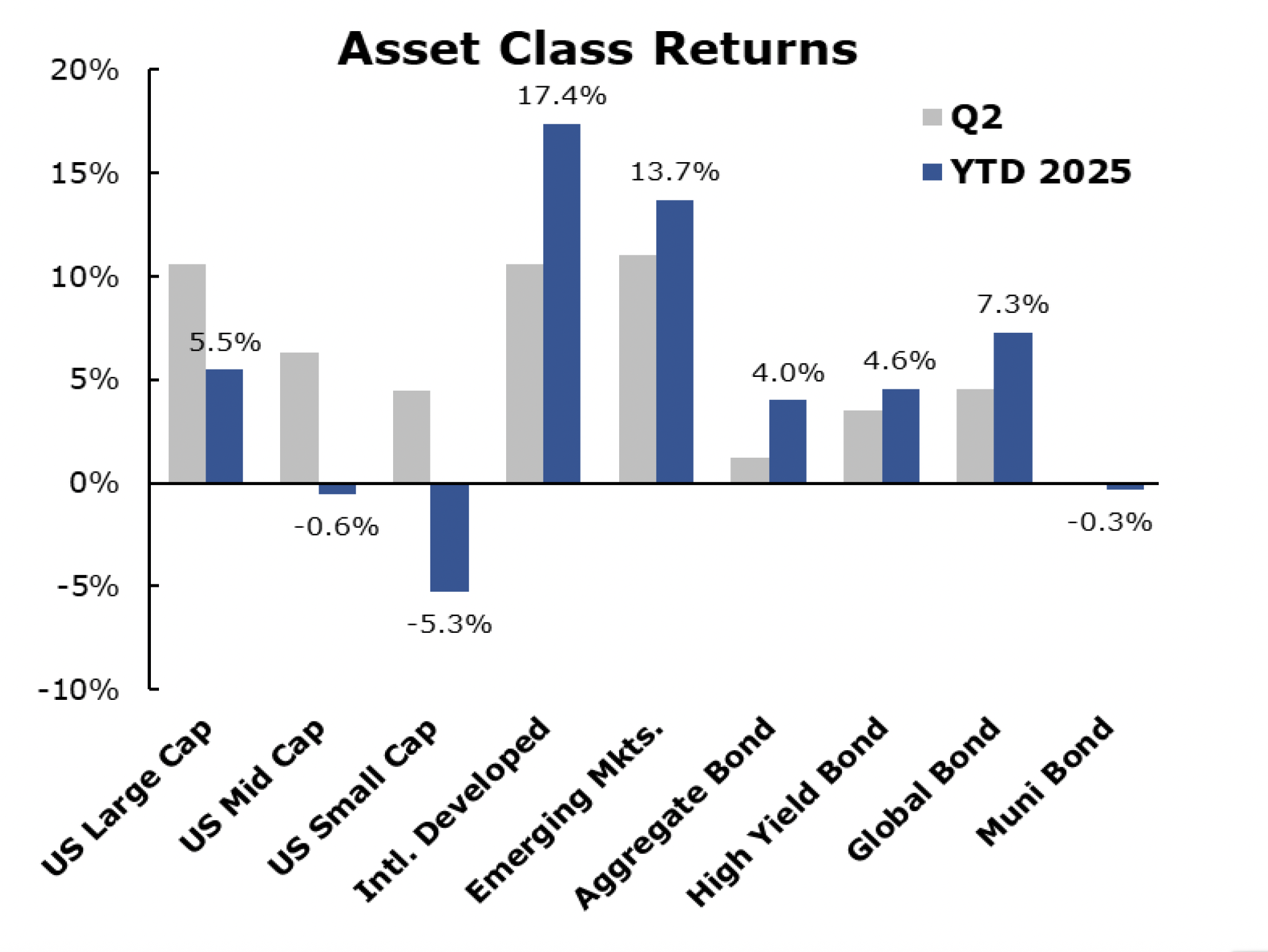

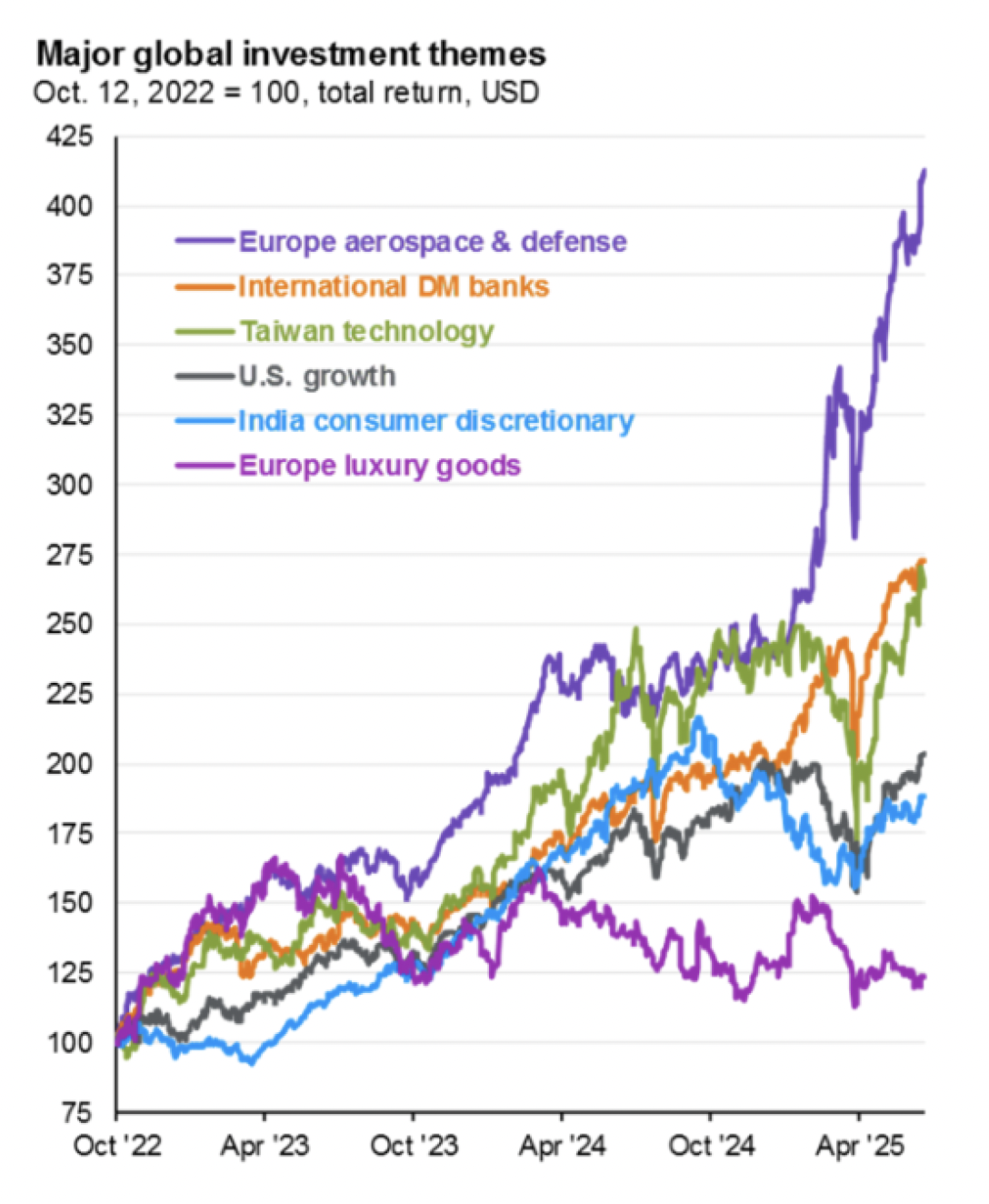

U.S. equity markets rebounded sharply after a turbulent start to Q2. The S&P 500 ended the quarter up 10.9%, reversing early April losses tied to “Liberation Day” tariffs that initially drove markets to correction territory. Large-cap growth, particularly in the technology and communication services sectors, ended up as the primary driver of gains, as investor enthusiasm around AI infrastructure and software adoption accelerated. Small-cap U.S. equities notably lagged, contrary to conventional expectations in a domestic-focused policy environment, as they remained more vulnerable to volatility, financing pressure, and wage-related margin compression. On the international front, developed market equities outpaced the U.S., a marked reversal of a decade-long trend. European equities were led by Germany’s aggressive €500B infrastructure investment plan, which lifted sentiment and growth projections. Meanwhile, emerging markets delivered a 15.6% YTD gain, fueled by stable monetary policy, improving fiscal discipline, and momentum in key regions like India, China, and Taiwan.

Bonds: Yield, Volatility, and Fiscal Reality

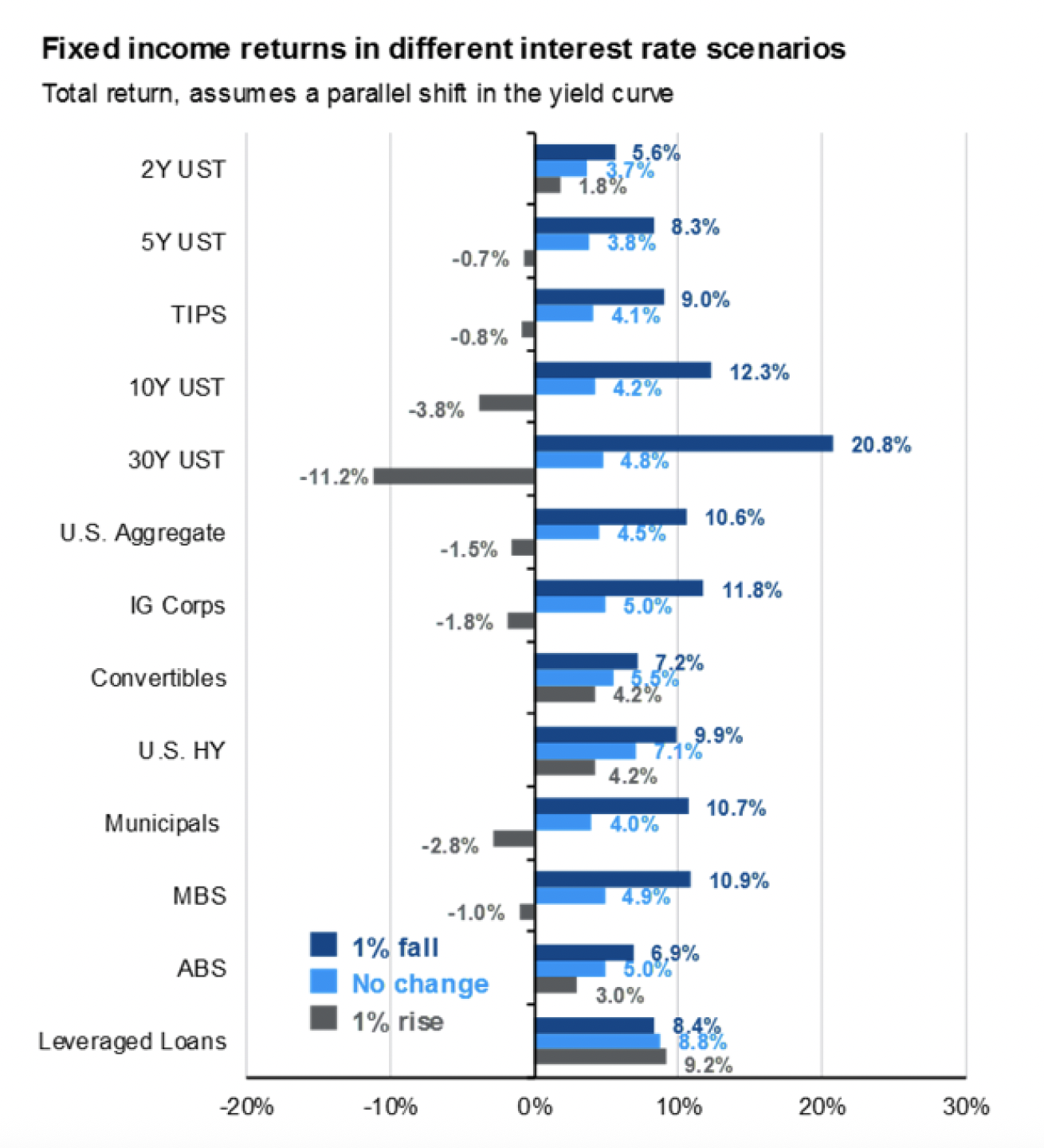

Fixed income markets experienced their own turbulence. Short-term investment-grade credit and agency mortgage-backed securities delivered positive returns, benefiting from stable interest rate expectations and demand for quality yield. The Federal Reserve did not change rates during the quarter, but futures markets began pricing in 75 basis points of cuts before year-end, aligning with actions from the European Central Bank and Bank of England. On the other hand, long-duration U.S. Treasuries experienced sharp and, at times, disorderly movements. Yields rose amid concerns over U.S. fiscal sustainability, especially in light of the “One Big Beautiful Bill” that expanded tax cuts and military spending could contribute to further U.S. credit rating downgrades. Globally, German bunds rallied as investors welcomed fiscal reform, while Japanese government bonds came under pressure as the Bank of Japan tilted more hawkish in response to pressure.

Alternatives & Real Assets Rising

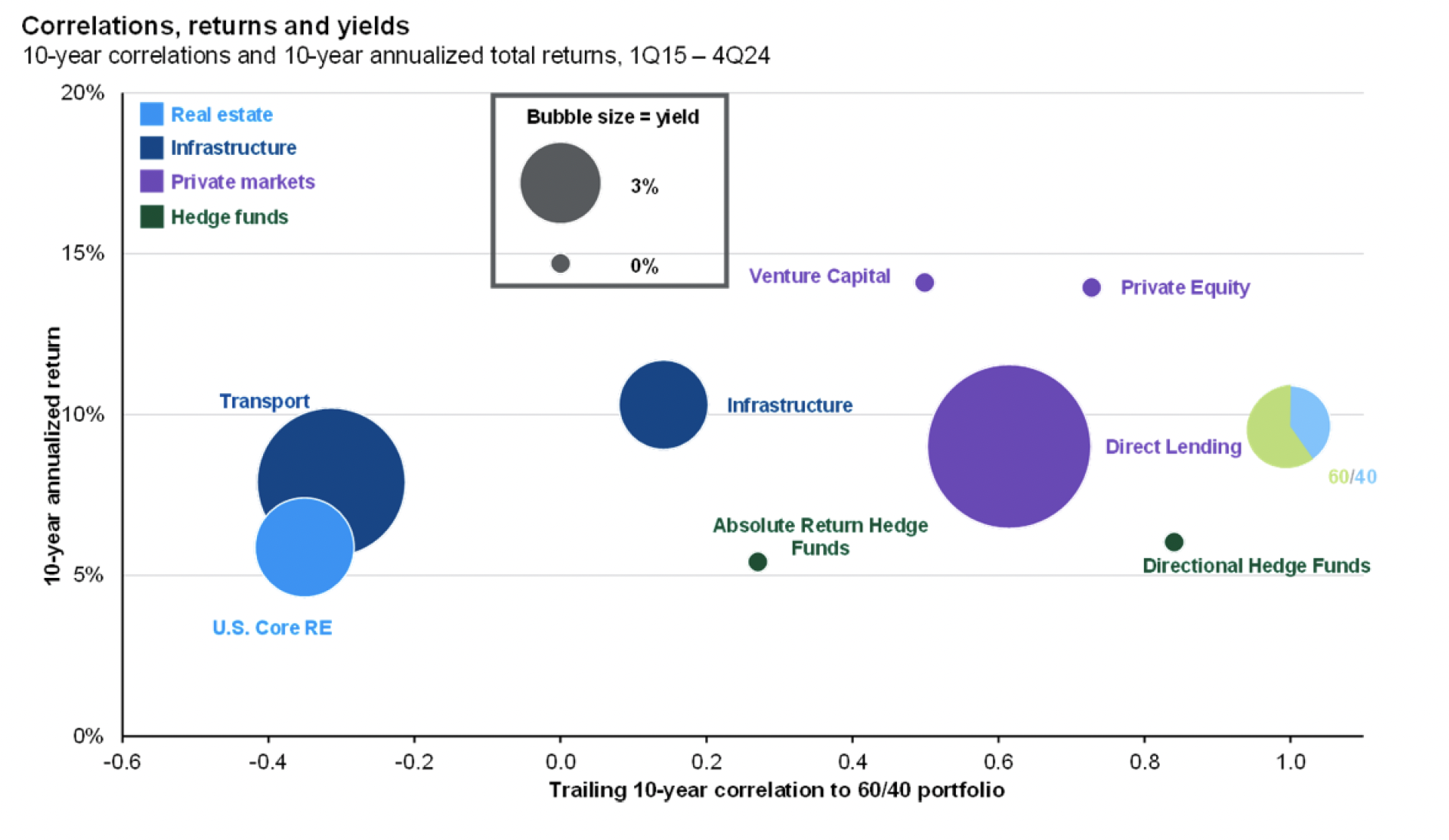

In alternative and real asset markets, results were mixed but directionally encouraging. Gold remained a popular hedge, rising steadily amid concerns about currency stability and elevated geopolitical risk. That said, sentiment is becoming stretched, with bullish positioning at multi-year highs, suggesting the potential for consolidation in the near term. Commodities saw renewed interest, though gains were uneven. Infrastructure continues to benefit from multi-decade investment trends tied to AI-driven electricity demand, energy security, and regional reshoring. Private credit also remains attractive, offering competitive yields and portfolio diversification, particularly as banks tighten lending standards and mid-market borrowers turn to non-traditional financing sources.

Volatility Isn’t the Villain—Reaction Is

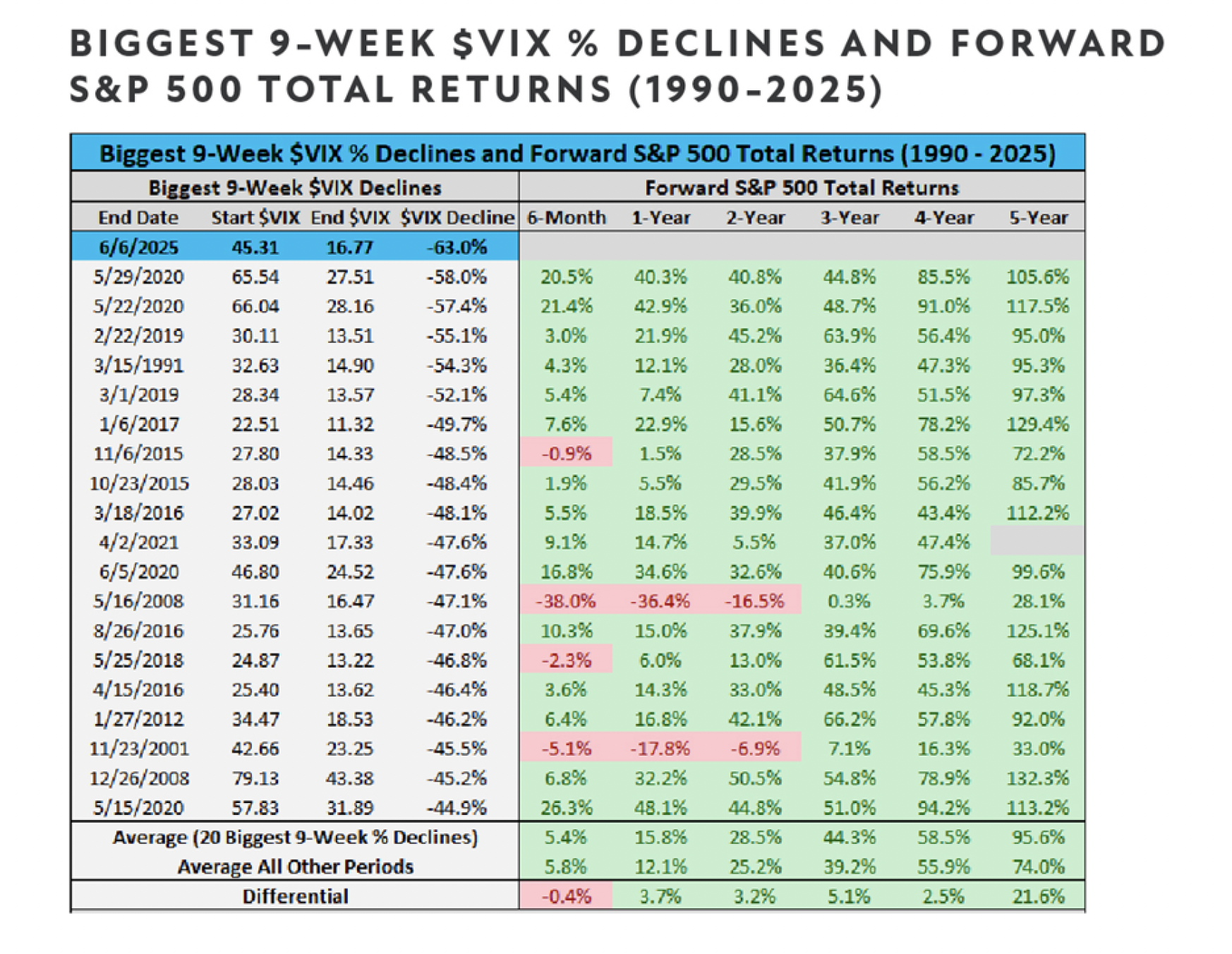

Beyond the numbers, investor behavior played a critical role in shaping outcomes this quarter. While the volatility seen in April was jarring—registering multiple six-standard deviation moves in some asset classes—the market’s rebound was equally historically rapid. The VIX, a measure of volatility, declined at the fastest nine-week pace on record, a pattern that historically precedes strong forward returns. We should remind our investors that volatility is not the problem but rather our response to it. Investors who remained focused on their long-term goals and avoided reactive decision-making tend to be rewarded, reinforcing the value of discipline. This quarter reminded us to stick to what we can control: asset allocation, tax efficiency, savings discipline, and rebalancing while tuning out the noise of geopolitical headlines, central bank speculation, and media-driven fear.

Summary

As we look ahead to the second half of 2025, we remain cautiously optimistic. The global economic environment continues to evolve, shaped by trade policy, fiscal dynamics, and secular technological transformation. Our portfolios seek to lean into themes like AI infrastructure, energy modernization, and emerging market dynamism while maintaining time-tested asset allocation strategies and hedges against inflation or fiscal disruption. We appreciate the trust you place in us and remain committed to helping you achieve your financial goals with clarity, confidence, and resilience.