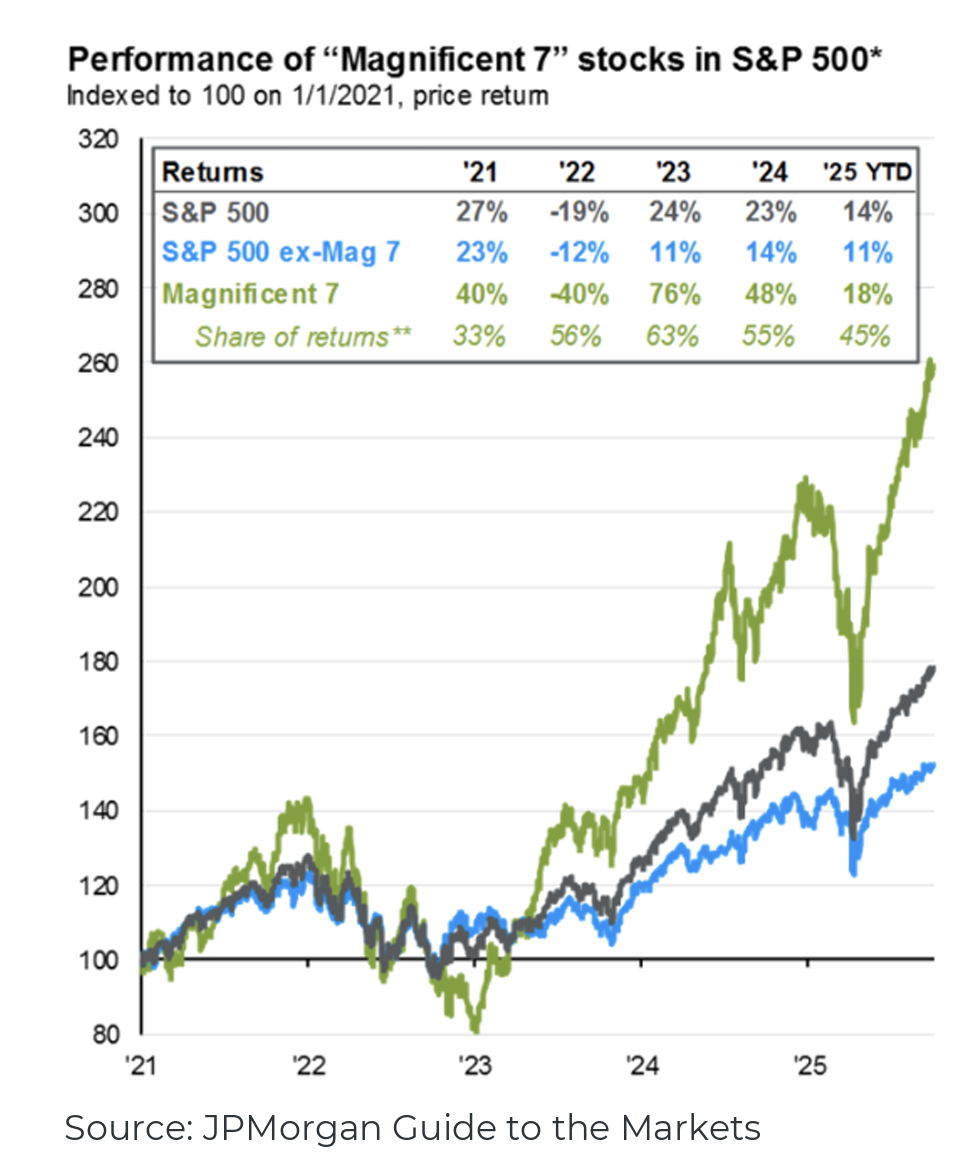

As we turn the page into the final quarter of 2025, optimism around rate cuts, strong corporate earnings, and AI-driven productivity gains helped the S&P 500 extend its rally. Yet beneath the surface of this enthusiasm lies a more complicated reality: valuations are elevated, leadership remains concentrated in a handful of mega-cap technology names, and economic signals are beginning to flash late-cycle caution. Globally, the story remains uneven—Japan and parts of emerging Asia continue to shine, while Europe faces manufacturing headwinds and fiscal constraints. Still, opportunities persist: bonds are finally offering meaningful income as quality-focused credit continues to reward patient investors and gold is regaining relevance as an inflation hedge.

Our goal continues to be focused on cutting through the noise and keeping portfolios positioned for resilience in a time of transition. Looking ahead, the investment landscape is evolving beyond the traditional 60/40 blueprint that served investors well for decades. As inflation, fiscal strain, and changing correlations redefine market dynamics, investors must embrace a broader, more adaptive toolkit. The future of portfolio construction will be built around balance of combining the liquidity of public markets with the potential innovation and income of private markets. The playbook of the past was about stability through simplicity; the playbook of the future is about resilience through flexibility.

Q3 Market Review

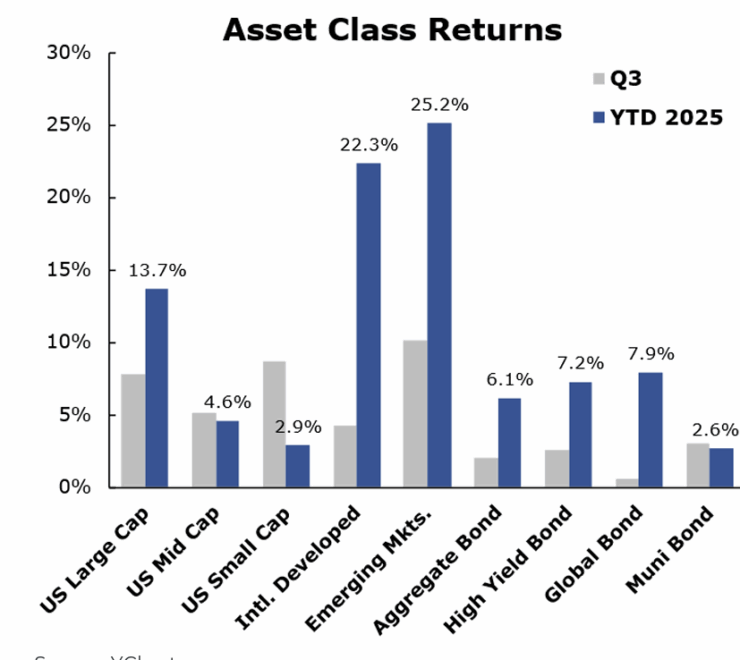

The S&P 500 kept its winning streak alive in Q3, continuing its climb as rate cuts and strong corporate earnings gave markets fresh fuel. Optimism remains high, but valuations may be stretched and the rally is still concentrated in a handful of mega-cap tech names. Beneath the surface, smalland mid-caps could offer the next leg of opportunity if leadership broadens out. Overseas, international markets were boosted by a softer dollar and a wave of global rate cuts, with emerging markets showing particular strength. Bonds held steady continuing to offer income and diversification. Gold stole the spotlight, surging above $3,850 amid renewed inflation worries and steady central bank buying, On the economic front, job growth cooled as AI reshaped hiring trends, leaving the Fed to walk a fine line between taming inflation and keeping the labor market afloat.

Late-Cycle Complexity & Policy Tension

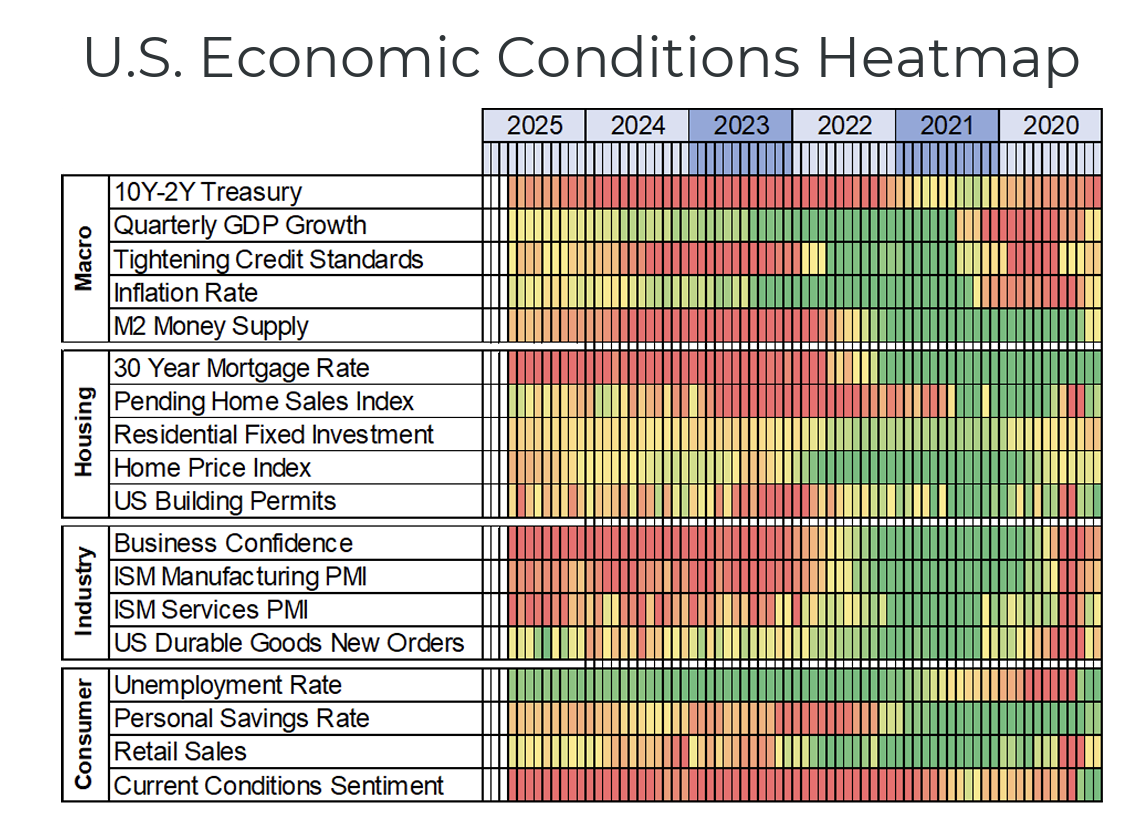

The U.S. economy remains caught between the strength of the consumer and the weight of policy uncertainty. After rebounding in the second quarter, growth has steadied at a moderate pace, supported by ongoing AI-driven investment and steady household spending. However, employment data show a cooling trend, and new tariff measures on pharmaceuticals, vehicles, and home goods are likely to put mild upward pressure on inflation heading into 2026.

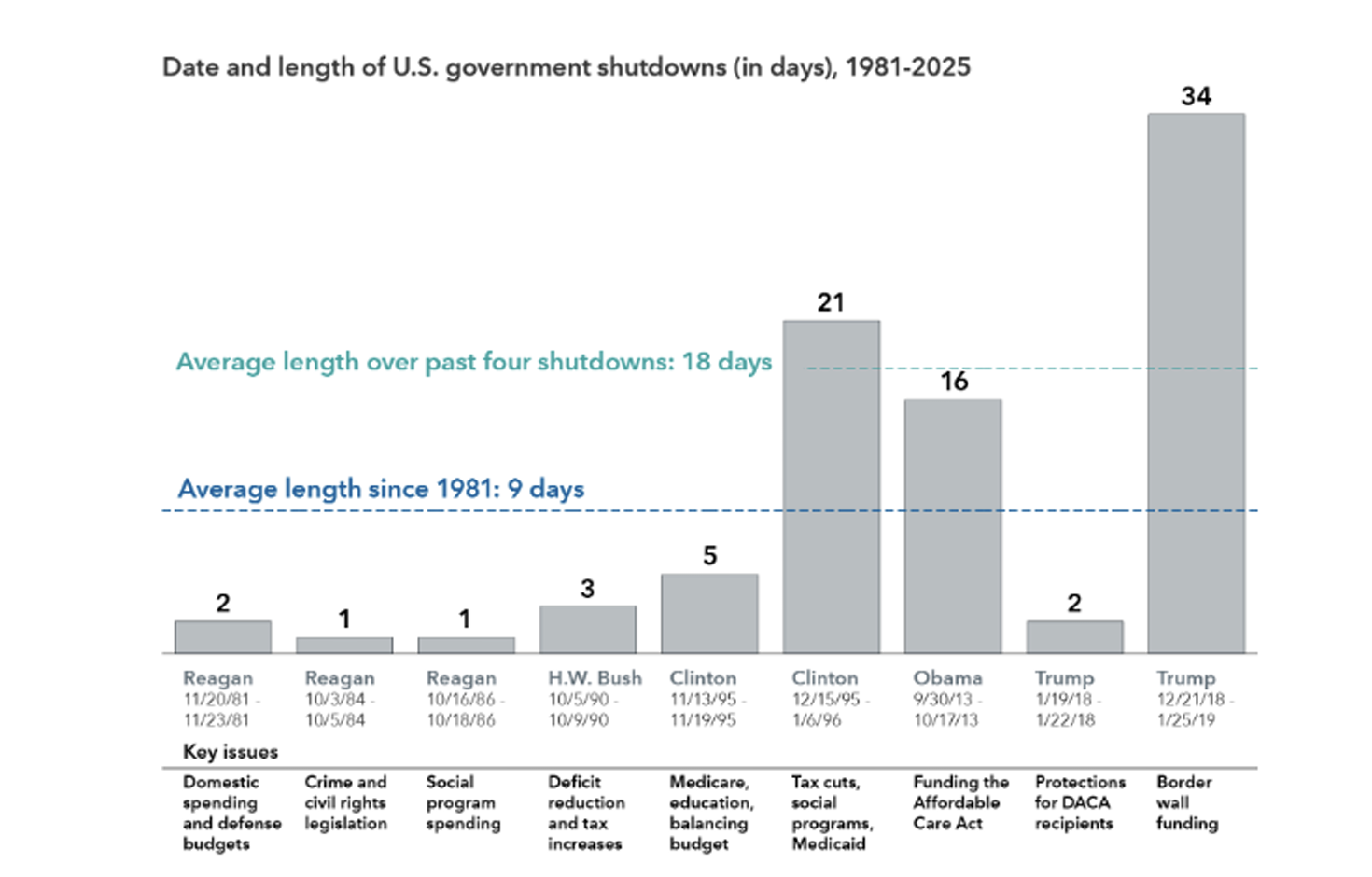

At the same time, fiscal tensions are reemerging. The U.S. government faces a potential shutdown as Congress debates funding beyond the temporary seven-week extension. Historically, shutdowns have been short-lived—averaging just nine days since 1981 but the political environment has grown more confrontational. The chart on page 3 highlights that while most shutdowns have lasted under three weeks, the 34-day closure in 2018–19 remains a stark reminder that today’s gridlock can linger longer than it has historically.

The current dispute centers on extending certain health care subsidies under the Affordable Care Act and reversing earlier Medicaid cuts, pitting fiscal restraint against social program funding. While markets may see temporary volatility, history suggests shutdowns tend to have limited long-term economic impact once resolved. We are monitoring the situation closely, especially as delayed government data releases could complicate monetary policy communication in the near term.

Globally, the picture continues to be uneven. Asia continues to show encouraging momentum, particularly in Japan where corporate reforms and tight labor markets have supported confidence. Europe struggles with manufacturing weakness and political uncertainty. Though inflation there has eased significantly, they are still vulnerable to energy shocks from the geopolitical backdrop.

AI Strength Meets Market Narrowness

U.S. equities remain anchored by robust earnings and capital spending, especially in technology and communication services. The AI-driven investment wave continues to shape productivity and profitability, and it has become a defining feature of this cycle. Yet market leadership has narrowed, with a small group of firms driving much of the S&P 500 Index’s return. To manage this risk, we continue to pair growth exposure with more defensive value investments, which tend to act as ballast when economic momentum slows. Outside the U.S., we favor Asia over Europe. Japan’s reform and attractive valuations stand out, while select emerging Asian markets seem to be benefitting from resilient domestic demand and renewed trade flows. In contrast, Europe’s earnings outlook remains challenged by weak manufacturing and constrained fiscal flexibility.

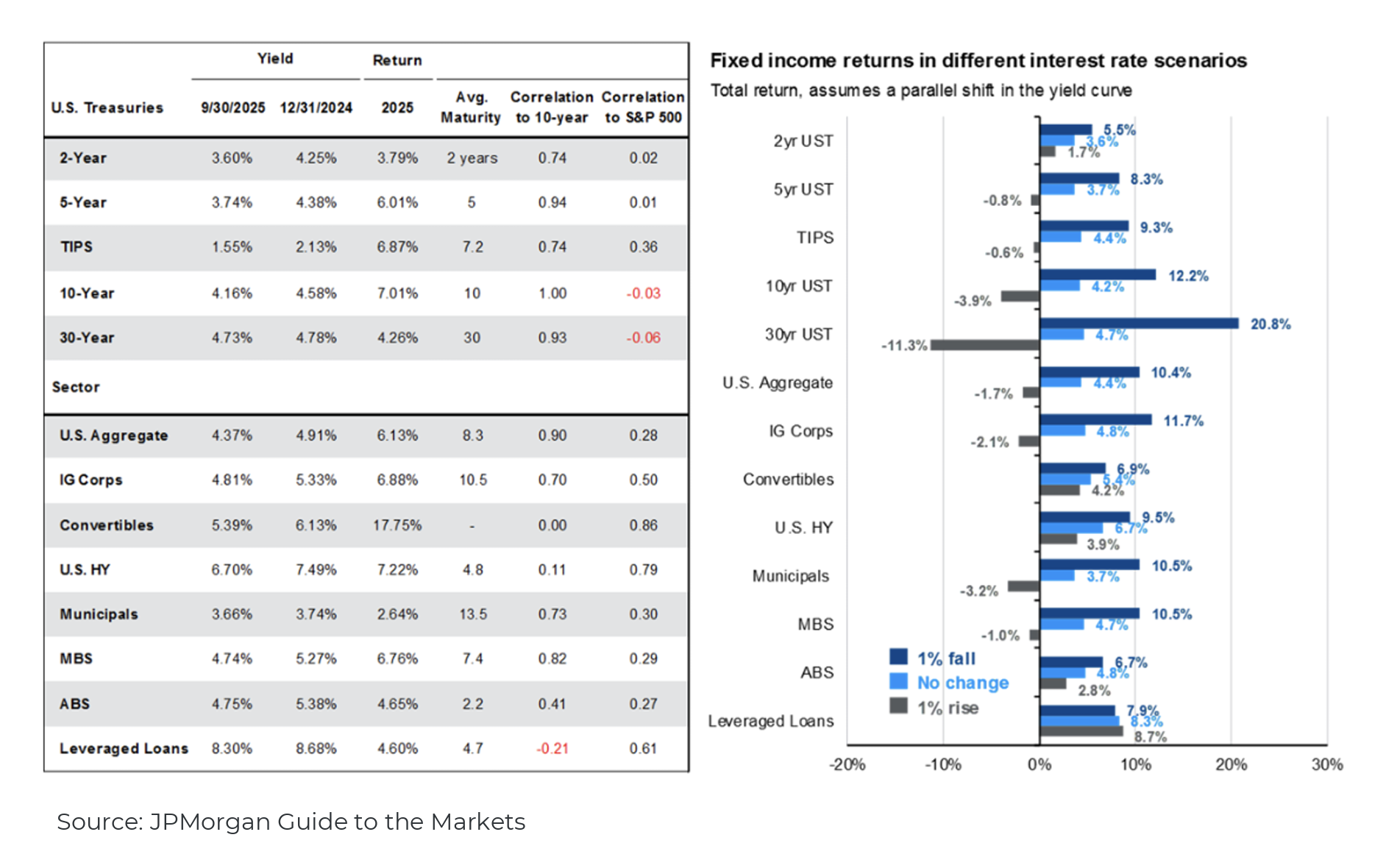

Opportunities Across the Curve

For the first time in more than a decade, bonds are once again offering meaningful income and defensive potential. We see value across the yield curve while yields remain elevated and duration risk is manageable. If economic data weakens or the Fed accelerates rate cuts, long duration fixed income could benefit greater than the short end of the curve. In the meantime, shorter- and intermediate-term maturities continue to serve as reliable income generators—steady “coupon clippers” in an uncertain environment.

As a whole, we seek managers who are focused quality fixed income. Currently, our managers utilized are blending traditional intermediate core exposure with quality opportunistic investments across the duration and style spectrum.

Alternatives: Expanding the Toolkit

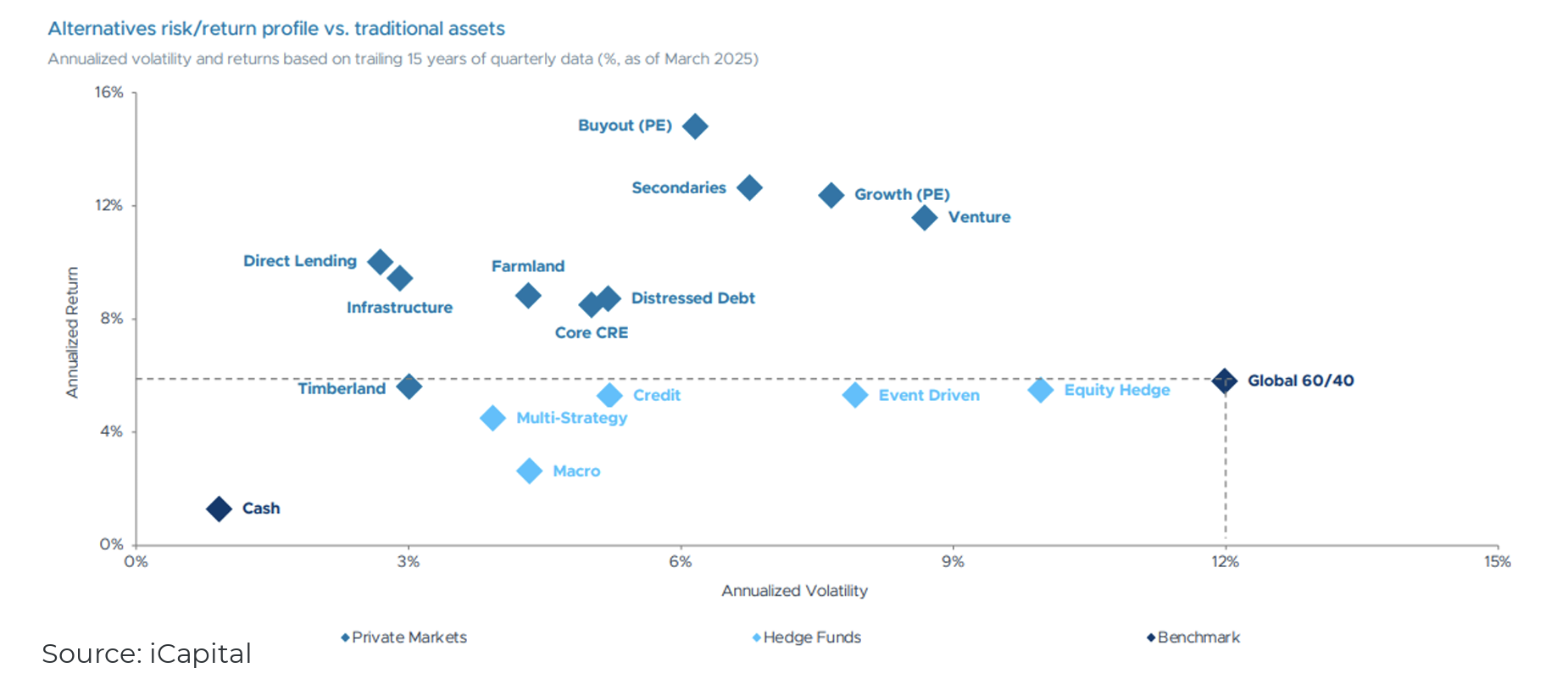

The classic 60/40 portfolio, which is regarded as the gold standard of balanced investing, has entered a new era. What once served as a dependable formula for growth and stability is now being tested by a shifting economic landscape marked by persistent inflation, fiscal strain, and tightening correlations between asset classes. Stocks and bonds, which for decades moved in opposite directions, are now often reacting to the same macroeconomic forces, reducing the diversification benefits investors have relied upon for generations. While bonds continue to play an important role in generating income and cushioning volatility, they no longer provide the same level of protection they once did when equities stumble. In today’s more complex and interconnected world, investors need a broader, more sophisticated toolkit which incorporates alternative investments to strengthen portfolios, build more resilience, and unlock new avenues for long-term growth.

Private equity is one of the most powerful complements to the traditional mix. While public markets have grown increasingly concentrated and volatile, private equity offers access to innovation and growth earlier in the business cycle—before companies reach public markets. Strong managers can capitalize on secular trends such as artificial intelligence, energy transition, and healthcare modernization, often with more control over timing, leverage, and value creation. Though illiquid, private equity’s long-term horizon can help investors ride out short-term volatility and capture a premium for patient capital. Alongside private equity, private credit continues to shine as banks retrench, providing investors with higher yields and floating-rate exposure backed by real assets or cash flows. The asset class now spans everything from senior secured corporate loans to asset-based finance and real estate credit.

For investors seeking steady income and diversification from public bond markets, private credit can provide both resilience and return potential. Liquid alternative strategies including market-neutral, multi-strategy, and managed futures strategies can add another layer of balance. These vehicles aim to have little to no correlation to stocks or bonds, which can portfolio volatility during equity drawdowns. They can also act as a bridge between the liquidity of traditional assets and the return profile of private markets, offering flexibility when opportunities shift quickly. Diversification today means more than just splitting exposure between stocks and bonds. It’s about integrating multiple dimensions of liquidity and transparency between public and private markets. In a world defined by higher volatility, structural shifts, and regime change, portfolios should be flexible, forward-looking, and thoughtfully diversified across both public and private opportunities.

Summary: Staying Resilient

The months ahead will likely bring a blend of optimism and uncertainty. A potential government shutdown may dominate headlines, but history reminds us that markets often look past short-term political drama. What endures are fundamentals: steady consumer demand, corporate profitability, and a growing universe of investment opportunities beyond the traditional 60/40 framework.

Staying disciplined and focused on long-term financial goals will be crucial in navigating the evolving landscape. As we like to remind our clients, time in the market is always more important than timing the market. Volatility is common in markets and, though it can make some uneasy, it is important to stick to a long-term plan. If you have any questions, please don’t hesitate to reach out to our team.

Disclosures

Asset allocation does not assure or guarantee better performance and cannot eliminate the risk of investment losses. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Concentric Wealth Management research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss. All investing involves risk including loss of principal. No strategy assures success or protects against loss There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss. The fast price swings in commodities will result in significant volatility in an investor’s holdings. Commodities include increased risks, such as political, economic, and currency instability, and may not be suitable for all investors. When referencing asset class returns or statistics, the following indices are used to represent those asset classes, unless otherwise noted. Each index is unmanaged, and investors can not actually invest directly into an index:

- US Large Cap – S&P 500 Total Return

- US Mid Cap – S&P 400 Total Return

- US Small Cap – S&P 600 Total Return

- International Developed – MSCI EAFE Total Return

- Emerging Markets – MSCI Emerging Markets Total Return

- Aggregate Bond – Bloomberg US Aggregate

- High Yield Bond – Bloomberg US Corporate High Yield

- Global Bond – Bloomberg Global Aggregate

- Municipal Bond – Bloomberg Municipal Bond

Domestic Equity can be volatile. The rise or fall in prices take place for a number of reasons including, but not limited to changes to underlying company conditions. International Equity can be volatile. The rise or fall in prices take place for a number of reasons including, but not limited to changes to underlying company conditions. Fixed Income securities are subject to interest rate risks, the risk of default and liquidity risk. U.S. investors exposed to non-U.S. fixed income may also be subject to currency risk and fluctuations. Cash may be subject to the loss of principal and over a longer period of time may lose purchasing power due to inflation sector or industry factors, or other macro events. These may happen quickly and unpredictably. International equity allocations may also be impacted by currency and/or country specific risks which may result in lower liquidity in some markets. Marketable Alternatives involves higher risk and is suitable only for sophisticated investors. Along with traditional market risks, marketable alternatives are also subject to higher fees, lower liquidity and the potential for leverage that may amplify volatility or the potential for loss of capital. Additionally, short selling involved certain risks including, but not limited to additional costs, and the potential for unlimited loss on certain short sale positions. S&P Total Return 500 – Covers the 500 largest companies that are in the United States. These companies can vary across various sectors. S&P MidCap 400 Total Return Index- A stock market index from S&P Dow Jones Indices. The index serves as a barometer for the U.S. mid-cap equities sector and is the most widely followed mid-cap index. S&P SmallCap Total Return 600 – Seeks to measure the small-cap segment of the U.S. equity market. The index is designed to track companies that meet specific inclusion criteria to ensure that they are liquid and financially viable. MSCI EAFE Total Return Index – An equity index which captures large and mid cap representation across 21 Developed Markets countries* around the world, excluding the US and Canada. The index covers approximately 85% of the free float adjusted market capitalization in each country. MSCI Emerging Markets Total Return Index – Captures large and mid cap representation across 25 Emerging Markets (EM) countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country. Bloomberg US Aggregate Bond Total Return Index – Used as a benchmark for investment grade bonds within the United States. Bloomberg US Corporate High Yield Total Return Index – Covers performance for United States high yield corporate bonds. This index serves as an important benchmark for portfolios that include exposure to riskier corporate bonds that might not necessarily be investment grade. Bloomberg Global Aggregate Total Return Index – Measures the performance of global investment grade fixed income securities. This index is widely used as a benchmark for fixed income securities. Bloomberg Municipal Total Return Index – Serves as a benchmark for the US municipal bond market. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Indexes discussed are unmanaged and you cannot directly invest into an index. Past performance is not a guarantee of future results.