The end of summer means that cooler Fall weather is around the corner. The famous all-American road trip winds down and everyone breaks out their coats and sweaters. Just as we’re now late in the year, it appears that the economy has many traits of tight, late-cycle conditions which may lead to choppiness in stock and fixed income markets.

As the seasons change, we believe so is the economy.

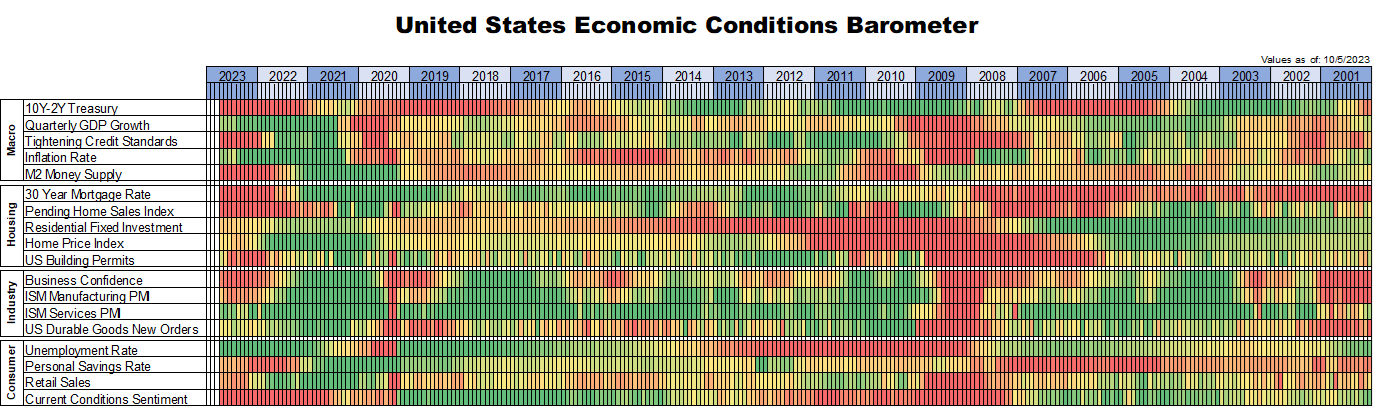

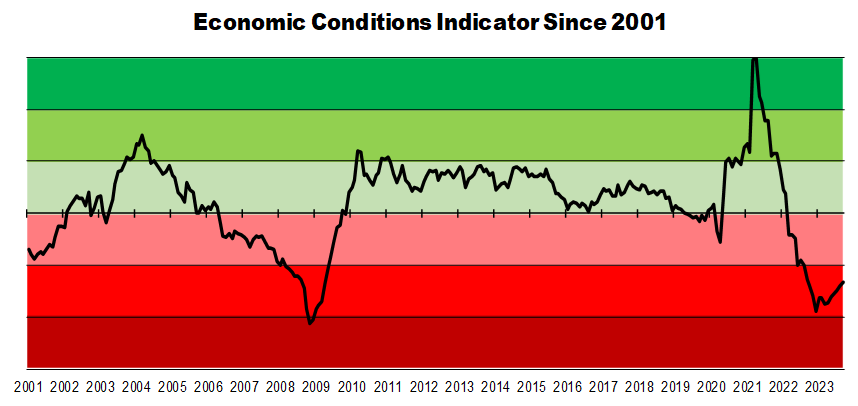

In our view, leading economic indicators are flashing near-recession conditions and lagging indicators are giving a nearly all-clear signal. Looking at leading signals from the consumer, housing markets, and industry reveal that growth may be challenged as we end 2023 and enter a new year. We have observed the consumers start to tighten their belt after a strong summer, the housing market starting to freeze up, and durable goods orders slowing down. In light of the flash banking crisis of March 2023, credit standards continue to tighten across the board which may lead to slowing economic growth as we end the year. Looking towards current and leading indicators, there has been noticeable improvement in areas such as the labor market, a declining inflation rate, and an increase in industrial production. With wage inflation creeping back in and the unemployment rate at 3.8%, the economy seems to be running efficiently but increasing output past this point could risk inflation increasing again.

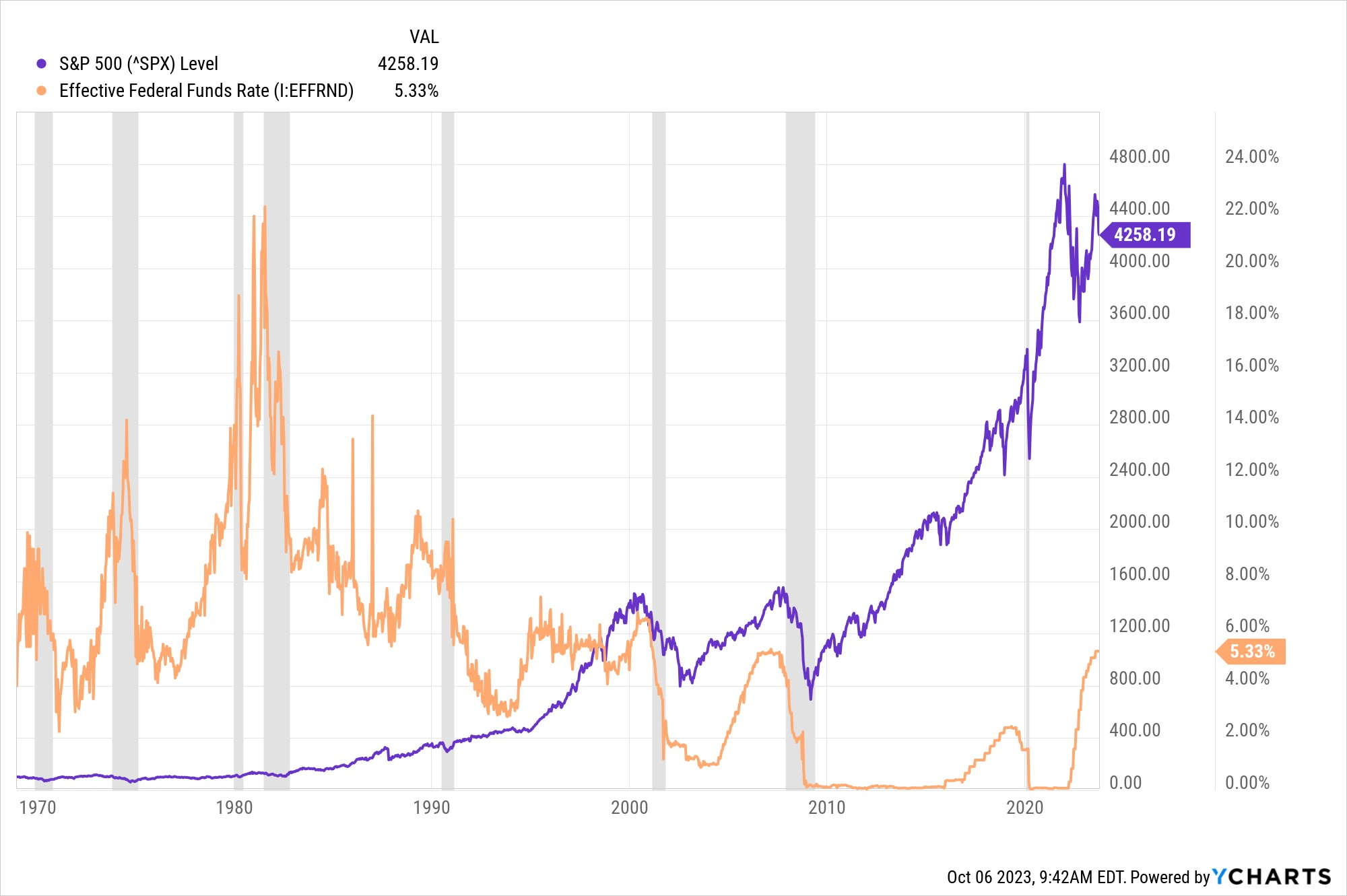

As seasons change, we believe that the U.S. Federal Reserve’s tone might be changing as well. After a break-neck interest rate hiking cycle, the Fed held off on increasing rates in September. The Fed continues to tout that they expect a “soft landing”, though the Fed has only pulled off one in modern history. Overwhelmingly, a recession develops sometime between the pause of an interest rate hiking environment and the first cut. We expect a mild recession to materialize in the first half of 2024 as there are significant risks that the Fed must navigate through in a high interest rate environment. We do find it unlikely that the Fed is able to achieve as soft landing as inflation seems unlikely to return to their 2% target given the tight labor market situation.

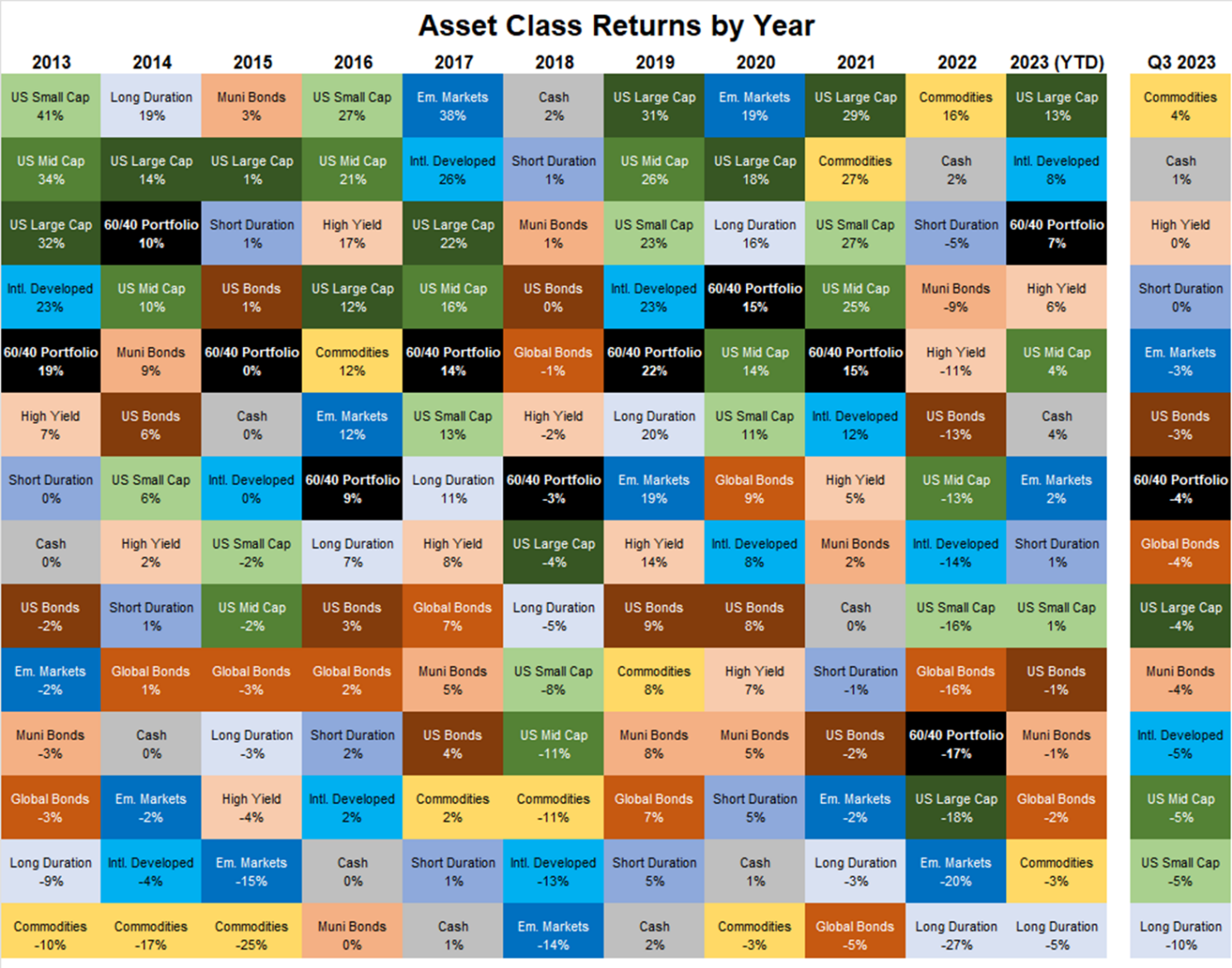

Equities were modestly lower around the world.

The S&P 500 slid 3.3% in the third quarter as the effects of high interest rates continue to sink its claws in to markets. What has been welcome is broadening U.S. market performance after being driven largely by the seven largest names during the first half of the year. International markets were weaker than the United States as the U.S. dollar strengthened, many countries overseas continue to grapple with high inflation, central banks continue tightening monetary policy, and global growth is generally slow with flared up geopolitical spats. The brightest spot of the third quarter was energy and energy-related stocks, which have been on fire as countries have tightened supply even in the face of steadily growing demand.

Fixed income struggled this quarter.

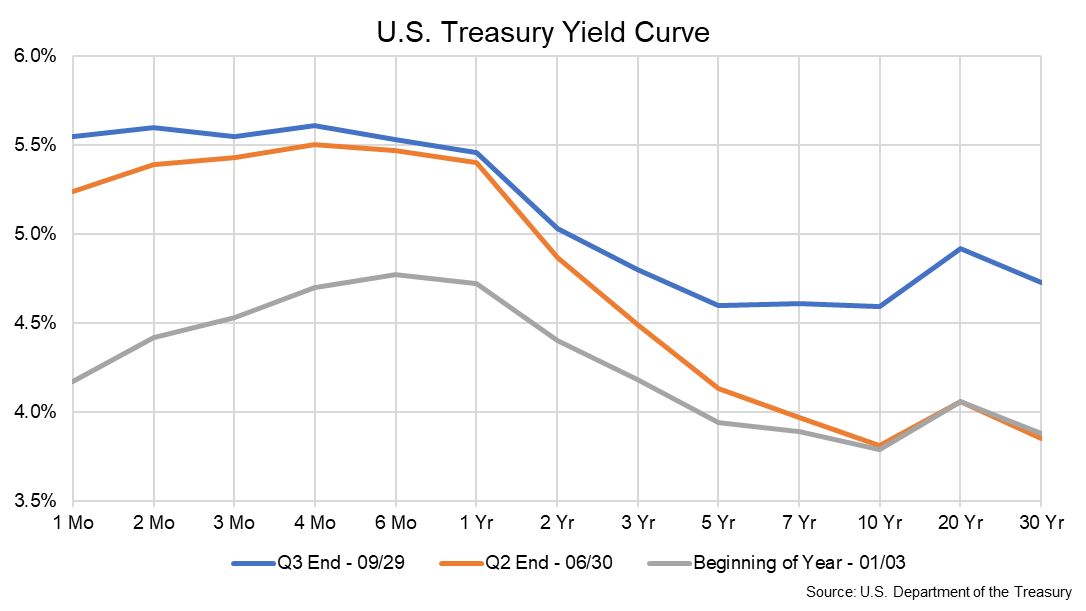

The key theme in fixed income markets was the 10-year U.S. Treasury yield steepening to above 4.5%, which may be a sign that the market is coming to terms with a higher-for-longer interest rate regime. As this mindset took roots this quarter, bonds struggled across the board. With July’s rate hike, the short end of the fixed income rate curve was pushed even higher. As Treasury yields were raised higher, this also pushed up corporate yields. Credit spreads continued to be tight and high-grade corporates seem to offer minimal benefit over Treasury securities. High yield bonds fared decently, though it does not appear that the market reflecting any slowdown or credit tightness in these lower-graded fixed income securities. International bonds struggled as rates went higher in their local markets as well as a strong dollar.

What we’re doing.

As we review portfolios, we are seeking to bring them towards a neutral asset allocation. We have a slight favor to U.S. stocks as most ex-U.S. economies are either later-cycle than we are or are already in a recession. We find valuations of international and emerging market equities to be incredibly attractive, though we monitor risks associated with a further strengthening dollar. We find that yields and prices in fixed income are attractive and tend to favor Treasuries, CD’s, and high-grade corporates across the duration spectrum. We see risks growing to the economy stemming from the Fed overtightening policy, leading to yields being pushed higher, which may end in a mild recession. We continue to explore alternative investments as a ballast to traditional stocks and fixed income including secondary private equity and private credit solutions. With the slightly overstretched valuations of public companies in the United States, we feel that direct private equity may struggle. As older vintage private equity funds seek to close, we find that discounts on companies they are willing to part ways with to be attractive on a go-forward basis. Private credit has become attractive as credit tightness from traditional banks has firms seeking alternatives for lending, which has many funds producing an attractive risk, return, and yield profile.

As we like to remind our clients, time in the market is always more important than timing the market. Volatility is common in markets and, though it can make some uneasy, it is important to stick to a long-term plan. If you have any questions, please don’t hesitate to reach out to our team.