2023 was the year that few predications came true. 2024 may be different.

Prelude

At the beginning of 2023, many of the Chief Investment Officers and Economists who set the tone for their respective firms called for a recession, a weak equity market, and a strong fixed income market. The thought was that inflation would taper off early in the year and that rate cuts could have happened before the end of 2023. With rate cuts, adding duration into portfolios would’ve been attractive. With rate cuts that (didn’t) occur, then value-oriented stocks would continue to outperform growth-oriented equities as they did in 2022. Last year was supposed to be the year of the small-cap stocks and international as well. As it turns out, the reality was completely the opposite to the prediction.

As we enter 2024 and look into our idea of a crystal ball, we see five key themes playing out domestically and abroad across asset classes.

Mild Recession and Rate Cuts

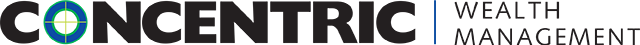

We’ve seen situations like we are currently in before. As we enter an election year, we are coming off a year of high inflation, rate hikes followed and a pause in tightening, and a relatively strong equity market. Entering 2023, many individuals on the street were calling for a recession. We did not think there would be a recession last year simply because the fed was not done hiking. As we’ve seen in the 1980’s, 1990’s, early 2000’s, and late 2000’s, there is a similar set up currently to those rate hiking cycle there of the past. As we have now entered what we believe to be the “pause phase” of the hiking cycle, we believe that a mild recession is likely to materialize sometime in the first half of 2024. Though we still have very strong growth that is supported by an uber-low unemployment rate, many of the world economies appear to be entering a slowdown phase or may already be in a recession based on GDP contractions and loosening fiscal policy.

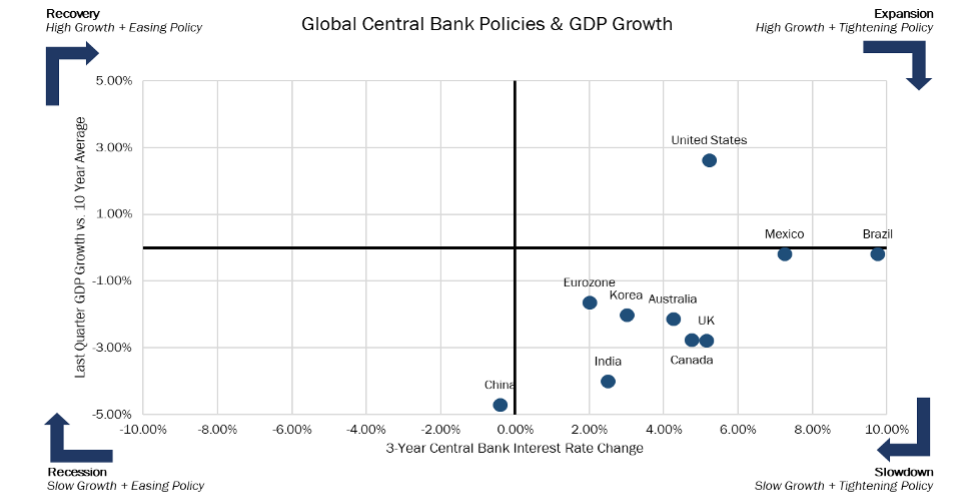

When we examine our proprietary United States Economic Conditions Barometer, we notice that we are still experiencing late cycle conditions and, as we dig deeper, the only thing in that appears to be supporting the United states economy is a low unemployment rate paired real wage growth. Low unemployment and real wage growth has a pro and a con aspect: to the pro side, the consumer can keep spending which could contribute to continued GDP growth period. On the con side, it risks inflation flaring back up which could lead to continually tight fiscal policy on a go forward basis.

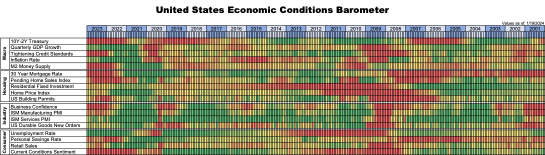

The Election and Political Uncertainty

In our opinion, the election is going to turn out to be a non-issue for markets. Leading up to the primary, there may be some softness in equities stemming from uncertainty to candidates on the ballot, but the latter half of the year entering 2025 could be positive. Markets are painfully objective: they look at what is going on and what level of uncertainty that creates. Uncertainty is directly related to increased or decreased volatility in the stock market. As of right now, we do not forecast major risks stemming from the upcoming United States primary and general election. Should there be concerns, we point to a succinct chart created by Capital Group which shows what has happened to your investment since 1932 across every election cycle.

We see continued risk stemming from an uncertain and everchanging geopolitical environment. Onshoring and nearshoring in a post-COVID world in tandem with potential for local conflicts flaring into regional conflicts would create uncertainty in markets. As the Russo-Ukraine conflict continues, no clear path or resolution in the Israeli-Palestinian Conflict, and continued tensions between China and Taiwan, we see these as potential tail risk that may boil over in into larger conflicts that could create significant uncertainty.

Soft Domestic Equities Relative to Foreign Equities

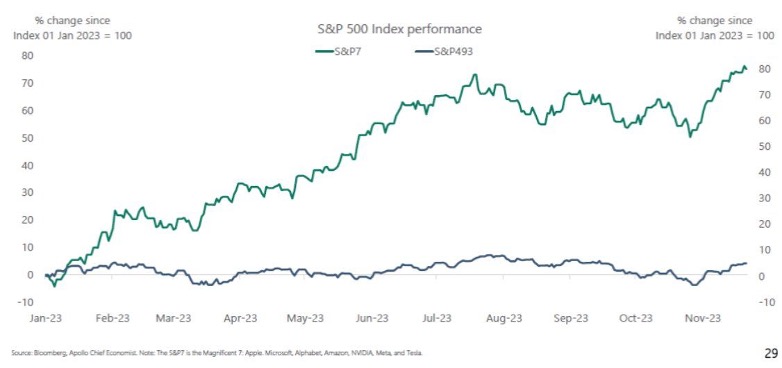

We expect the S&P 500 to end 2024 around 5,000, which would be a 6 to 7% total return for the full year of 2024. In the United States, we believe that mid-cap and small-cap companies may outperform their large-cap peers as the S&P 500 has become incredibly concentrated in the top ten names, with them making up nearly 30% of the weight in the S&P 500. When you look at the valuation of the top 10 versus the bottom 490 stocks in the S&P 500, the top 10 stocks run at nearly a 40% premium P/E Ratio relative to the S&P 500 whereas the bottom 490 run at about a 20% valuation discount relative to the S&P 500. After the substantial price performance of the top 10 names in the S&P 500 in 2023, we believe that there is more downside risk to the top 10 names which may drag on returns while the bottom 490 may have attractive returns for the year.

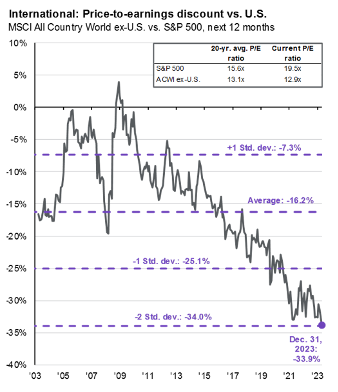

Even in the midst of heightened geopolitical tensions, we believe that international developed equities and emerging equities have the potential to outperform United States equities on a relative basis. There are three factors currently working in the favor of international equities:

- The dollar weakening from its all-time strength.

- A high interest rate environment turning into a more normal interest rate environment which may end higher than the post-Great Financial Crisis Era.

- A P/E discount nearly two times below the average U.S. P/E Ratio

Fixed Income’s Year to Shine

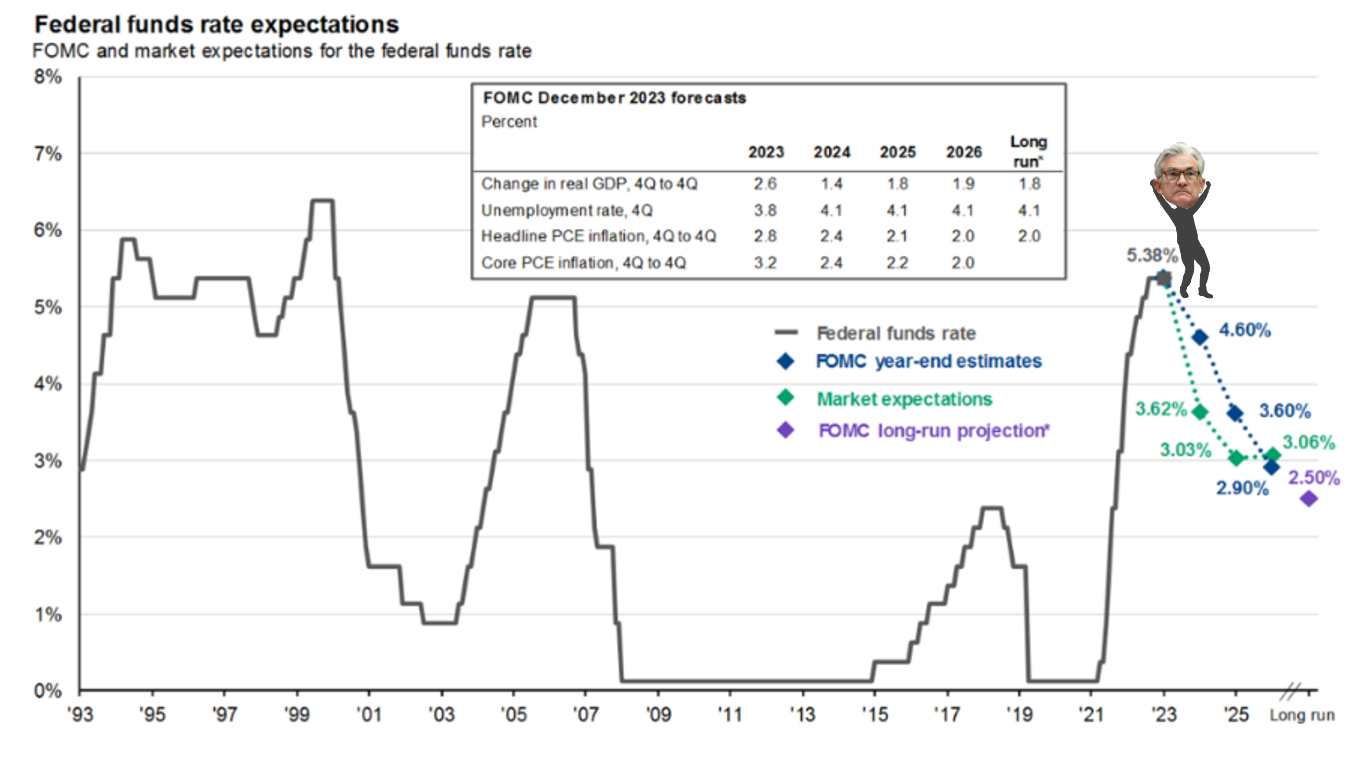

Many have commented on Fed Chair Jerome Powell was riding a rainbow in our graphic on page one. The chart above highlights the one prominent theme which could propel price returns on fixed income securities: rate cuts. In our time of reviewing fixed income managers, we have never seen managers in a normally plain vanilla space become more excited. The basic paper napkin math is that for every 1% in the increase or decrease of the Fed Funds Rate, a bond will experience the opposite of that effect times years to maturity.

For the argument, let’s assume an investor has a bond that is coming due in 2030 (6-year maturity) with a 5% coupon. If the Fed hikes rates from this point, you may experience a 6% decline in the price of the bond but, with a 5% coupon, your total will turn would end up around -1%.

It is our belief though, that the Fed will be forced into two rate cuts in the latter half of 2024 totaling 1%. In this case, your bond would experience price appreciation of 6%, plus a 5% coupon, totaling an 11% potential total return. We have highlighted another chart from JP Morgan Chase’s “Guide to the Market”, which gets a little bit more into the nitty gritty of the potential price appreciation of various fixed income products across the spectrum based on rate hikes and cuts.

Should our beliefs stand true that rate cuts will occur, we foresee prospects for significant total return in fixed income securities that could potentially surpass that of their equity counterparts. As such, for folks that are holding high cash balances, we wish to engage in conversations to deploy that cash primarily into fixed income.

Continued Strength in Real Assets and Alternative Investments

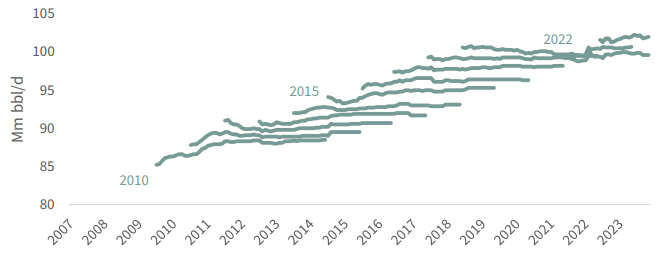

As 2023 marked the end of full COVID Era Restrictions, the consumer is back and better than ever for the time being. With fresh stimulus still in their pockets, demand continues to grow faster than supply. We see commodity strength on the horizon as consumers need more and want more. Commodity markets are painfully simple and may take many back to their Economics 101 course: when demand is increasing with limited supply, prices will move up. The IEA has continually projected growing demand for fossil fuels over the next 10 to 20 years. When this is paired this with the amount of rare Earth and industrial metals that are needed to create electric vehicles, a growing world population, and new emerging markets in rapid growth phases, we believe that commodities should continue in upwards price movement and we are positioning portfolios to take advantage of this.

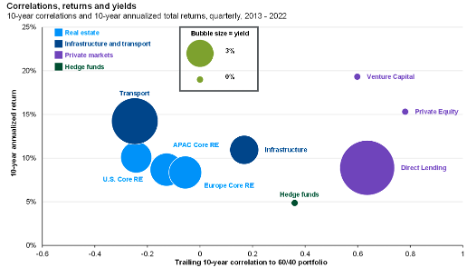

We are seeking to minimize exposure to broad real estate. We believe that a high interest rate environment amplified by tightening credit conditions may lead to commercial real estate developers to experience a rut. There are some areas of real estate that we are upbeat on which include last mile distribution, data centers, self-storage, farmland, infrastructure, mixed-use development, specific single family home rental strategies, and specific hospitality and entertainment strategies.

For alternative investments, we find opportunity in private equity and private credit. In terms of private equity we look forward to working with Connectic Ventures located in Covington, Kentucky upon the launch of their public venture capital fund, which will be the first in the world of the style, in Q1 of 2024. They have assembled an all-star team and have built a revolutionary program for the venture capital space. We continue to find attractive risk and return profiles across the venture capital space, growth equity space, and buyout private equity space. Private credit continues to be attractive from a yield perspective as well as an opportunity set perspective. Though there has been an uptick in private credit funds and issuers, the opportunity set has steadily expanded as private credit managers have made capital more accessible.

Summary

We look forward to working with individuals and businesses throughout the year in navigating markets, financial planning, and taxes. As we like to remind our clients, time in the market is always more important than timing the market. Volatility is common in markets and, though it can make some uneasy, it is important to stick to a long-term plan. If you have any questions, please don’t hesitate to reach out to our team.